cryptocurrency tax calculator us

Its important to be aware that it does not matter if you are selling your crypto for USD EUR or another cryptocurrency. Capital losses may entitle you to a reduction in your tax bill.

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Choose your tax status.

. Select your tax filing status. Blox free Pro plan costs 50K AUM and covers 100 transactions. Enter your income for the year.

For most people this is the same as adjusted gross income AGI. Choose how long you have owned this crypto. Derive your estimated gain or loss Determine the estimated capital gains taxes.

Income from the transfer of digital assets such as cryptocurrencies like Ethereum Dogecoin Bitcoin etc is taxed at a flat rate of 30 without allowing deduction of expenses except for the cost of acquisition. This means you can get your books up to date yourself allowing you to save significant time and reduce the bill charged by your accountant. Selling a cryptocurrency or digital asset for fiat currency is a taxable event.

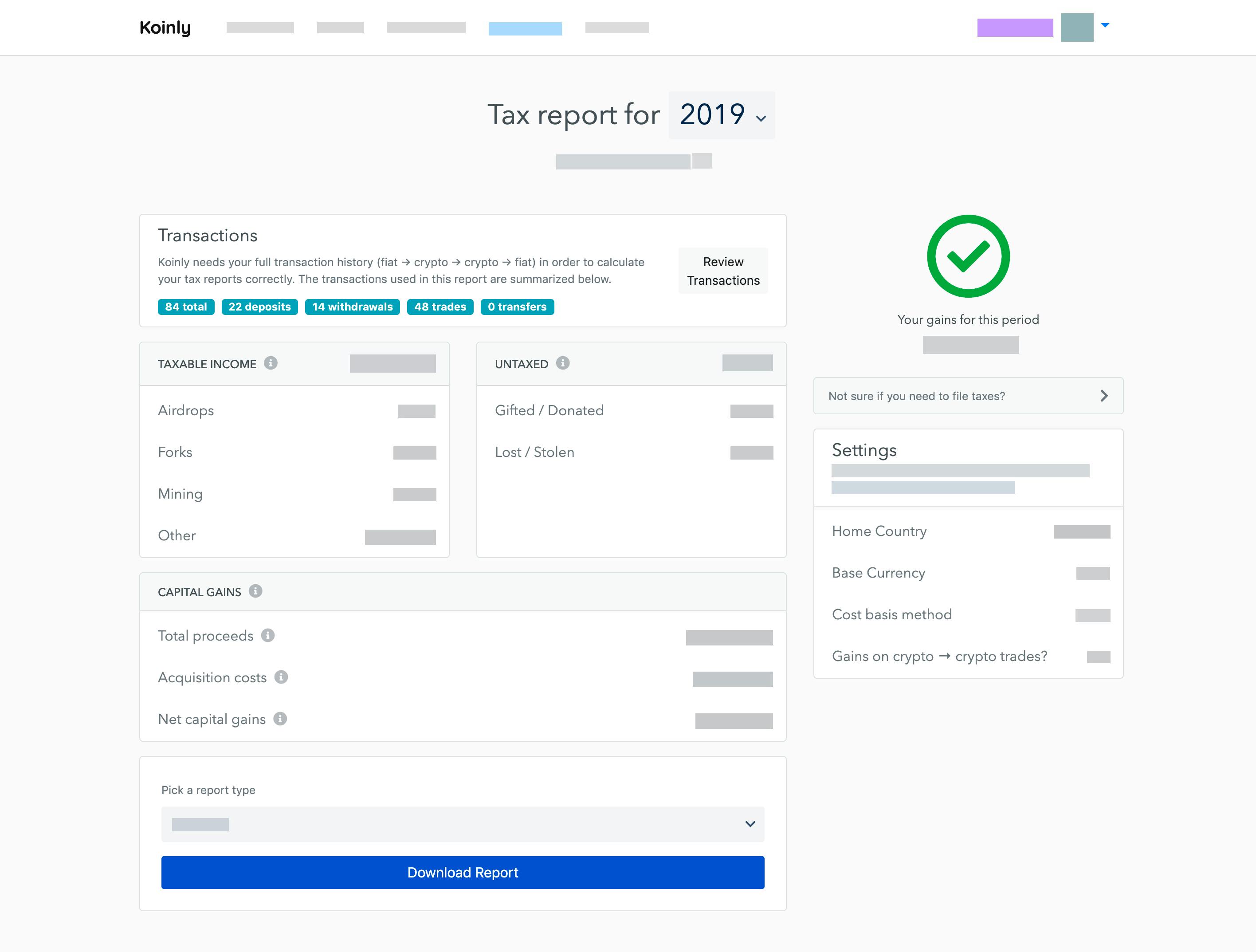

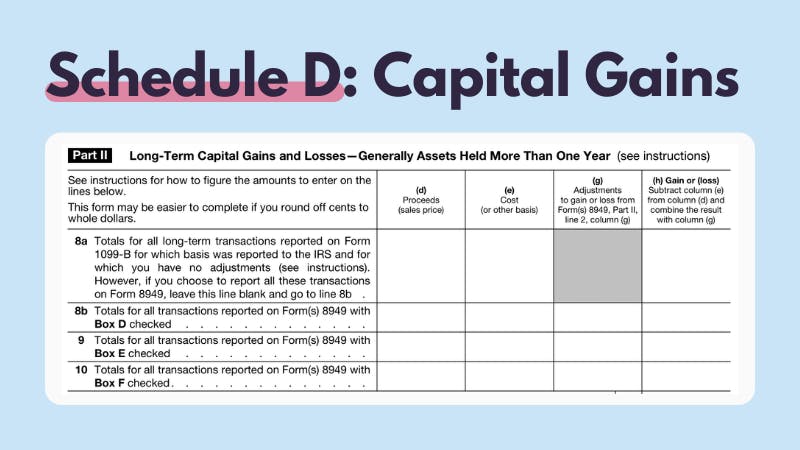

It also automatically calculates a users capital gains and losses simplifying the process of calculating tax returns and generating a draft Form 8949 on sales. There are cloud-hosting tools specifically designed for crypto miners. Her total income is 50000.

Yes CryptoTaxCalculator is designed to generate accountant friendly tax reports. Another example is your annual income is 35000 and you bought 500 of BTC on August 1 2020. Uses your cryptocurrency transaction history to generate a Schedule easily.

Crypto tax calculators are essential for every trader and throughout this article we will cover the best crypto tax calculators and talk in-depth about crypto taxing. 15 Best Crypto Tax Softwares Calculators in 2022. You simply import all your transaction history and export your report.

The popularity of cryptocurrencyBitcoin investments continues to skyrocket. Using this calculator you can. The business plan comes at 99 per month and covers 10K taxations and 20 million in assets.

The Result is. She will pay 12 Income Tax on 50000 which is 6000. Crypto from a tax perspective A key distinction between cryptocurrency and fiat.

If you sell it at 1500 on August 2 2021 you incurred a long-term capital gain of 1000. A major consideration from a state tax perspective is whether or not the purchase of virtual currency or cryptocurrency is a taxable sale for sales and use tax purposes. The use of this website is not to be constitute intend or to be considered tax advice financial advice legal advice or tax.

The Taxes Owed are. According to the rates tabulated above youll have to pay 0 taxes. More than 12 months is considered long-term capital gain and youll pay 0 to 20 of the capital gain in taxes.

According to a May 2021 poll 51 of Americans who possess cryptocurrencies did so for the first time in the previous 12 months. US Tax Guide 2022. This will depend on.

So tax owed 25 Capital gains 025 1000 250. You can discuss tax scenarios with your accountant. ZenLedger is a popular cryptocurrency tax administration and accounting software.

Select the tax year you would like to calculate your estimated taxes. Tax-Loss Harvesting With A Crypto Tax Calculator. Traders can use ZenLedger to import crypto transactions calculate income tax and crypto tax bills and prepare tax returns.

Enter Your Personal Details. In general terms losses resulting from cryptocurrency trades are tallied against any gains made in the current year. Your total capital gains for the entire the tax year including gains made from non-crypto trading - the more you made the higher your tax.

Tax on Cryptocurrency in India. On the opposite side of the spectrum those making 518401 or. Regardless of whether the gain is a short-term or long-term capital gain the tax must be paid by.

In this scenario your cost basis is 10000 and your gain is 5000. However even though interest in cryptocurrencies continues to expand and the IRS has. The majority of states have not yet issued guidance on the tax treatment of virtual currency or cryptocurrency.

Enter your taxable income excluding any profit from Bitcoin sales. Your gain is the amount youll be obliged to pay taxes on. Claudia is filing as the head of her household and so her Federal Income Tax rate is 12.

The transaction will be considered a taxable event by the IRS as long as you are. To help you with your tax planning for tax year 2021 you can also find out if you have a capital gain or. Enter your states tax rate.

With more than 15K customers this crypto tax calculating application simplifies crypto tax to investors and tax professionals. In 2014 the IRS decided to treat cryptocurrencies like stocks and bonds rather than currencies like dollars or euros. This is a simplified calculator to help you calculate the gains of your cryptocurrency.

Selling your crypto for cash. Also used by tax professionals this powerful cryptocurrency tax calculator simplifies the crypto tax accounting procedure. If your annual income is less than 9875 youll be subject to a 10 tax rate on your crypto.

This is a very simple formula if for example you only bought and held one Bitcoin and sold that one Bitcoin. This guide details the tax obligations for crypto investors and answers many commonly asked questions on a wide range of scenarios that may apply to your crypto investments. But how much tax do you have to pay.

Less than 12 months is considered short-term capital gains and youll pay 10 to 37 of the capital gain in taxes. The long-term capital gains tax rate depends on your total income and is anywhere between 0 and 20 for cryptocurrencies in the US. You are liable for capital gains tax on the amount if any that your original holding appreciated in value since you bought it.

Between 16th of April 2021 and 14th of April 2022 Claudia earns 40000 from her job and 10000 in crypto earnings. ZenLedger is a crypto tax software that supports integration with more than 400 exchanges including 30 Defi Protocols. Taxpayers should also seek guidance on how to calculate the.

Expanding on the capabilities of the EY CryptoPrep tool released in summer 2020 this new tax calculator imports transactions from numerous major cryptocurrency coins and exchanges. Forbes recently posted this handy guide with a chart of the 2020-2021 tax brackets for your reference. You can use this calculator to get a quick estimate of the taxes you may owe in 2021 on your cryptocurrency gains.

Blox supports the majority of the crypto coins and guides you through your taxation process. The easiest answer to this problem is cryptocurrency tax software which takes account of your activities seamlessly. Free Crypto Tax Calculator for 2021 2022.

Check out our free Cryptocurrency Tax Interactive Calculator that in just one screen will answer your burning questions about your cryptocurrencyBitcoin sales and give you an estimate of how much your sales will be taxed and much more.

How Is Cryptocurrency Taxed Forbes Advisor

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

10 Best Crypto Tax Software Solutions 2022 Reviews Fortunly

How To Cash Out Crypto Without Paying Taxes In Canada Jul 2022 Yore Oyster

Best Crypto Tax Software Top Solutions For 2022

How To Do Your Binance Us Taxes Koinly

How To Calculate Crypto Taxes Koinly

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Cryptocurrency Tax Calculator Forbes Advisor

Irs Crypto Tax Forms 1040 8949 Koinly

How To Calculate Cost Basis In Crypto Bitcoin Koinly

Cryptocurrency Tax Reports In Minutes Koinly

![]()

Cryptocurrency Bitcoin Tax Guide 2022 Edition Cointracker

How To Calculate Crypto Taxes Koinly

Irs Crypto Tax Forms 1040 8949 Koinly

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare